Sukuk bonds traded on London stock exchange 2009-2016. Islamic financing in Malaysia was kick-started in 1983 when the Islamic Banking Act 1983 the countrys first law for Islamic banking was passed.

Malaysia New Issuance Bonds And Sukuk 2020 Statista

The Ministry of Finance wishes to announce the issuance of Sukuk 1Malaysia 2010 amounting to RM3 billion on 21 June 2010.

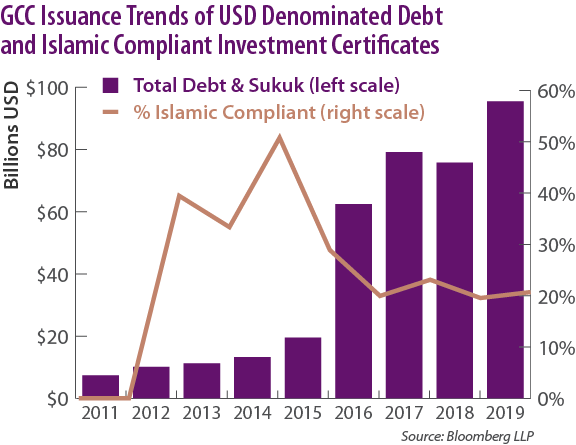

. Mar 5 2021. The allocation was well-spread globally with 65 of the principal amount of the 10-year Sukuk distributed to Asia 19 to Middle-East 11 to Europe and 5 to. The outstanding bonds and sukuk value in Malaysia amounted to around 16 trillion Malaysian ringgit in 2020 in which the Islam-friendly counterpart of bonds makes up a huge share.

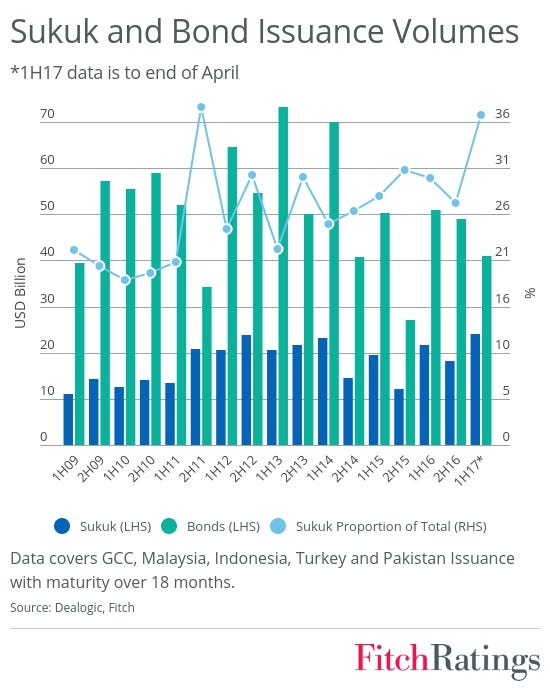

In 2016 global sukuk market witnessed a rebound after three consecutive years of decline following its peak in 2012. Property-casualty insurance company corporate foreign bond. Value of redemption bonds and sukuk Malaysia 2016-2020 Value of outstanding bonds and sukuk Malaysia 2016-2020 Islamic finance.

10239 billion Malaysian ringgit was reached with new islamic friendly bonds in 2019. The expected rating is in line with Malaysias Long-Term Foreign Currency Issuer Default Rating IDR of A- which has a. Bank Negara Malaysia has been appointed to issue the sukuk on behalf of the Government.

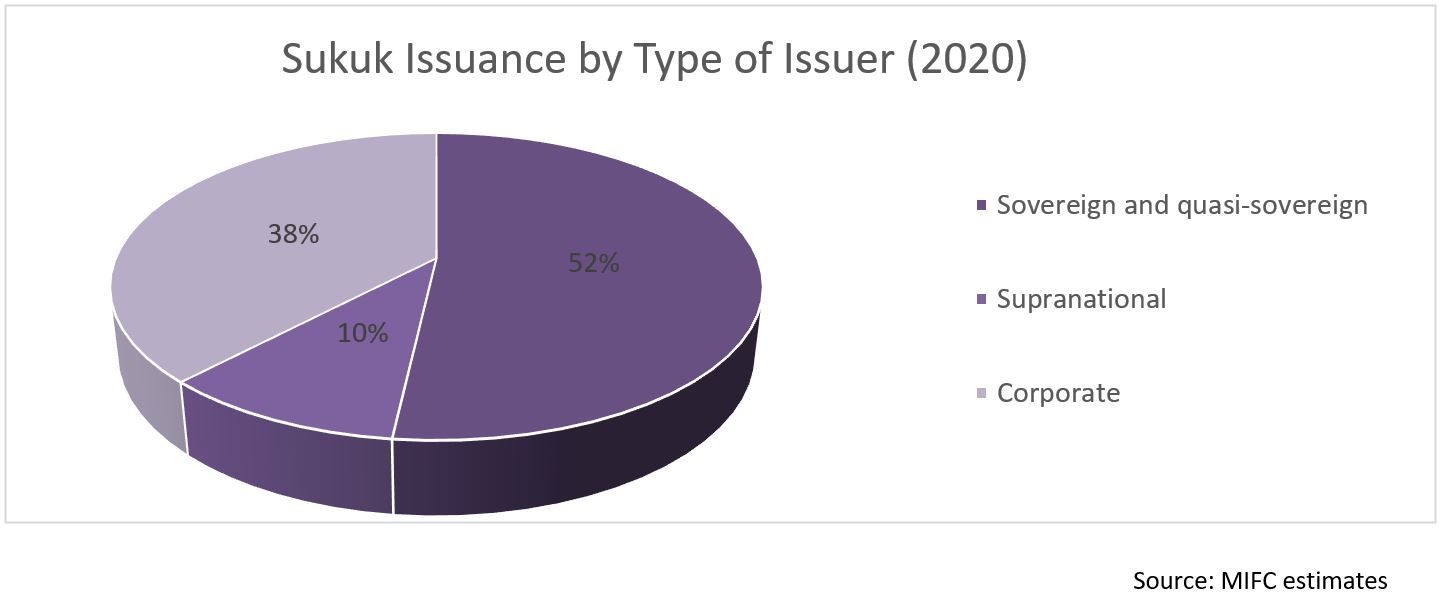

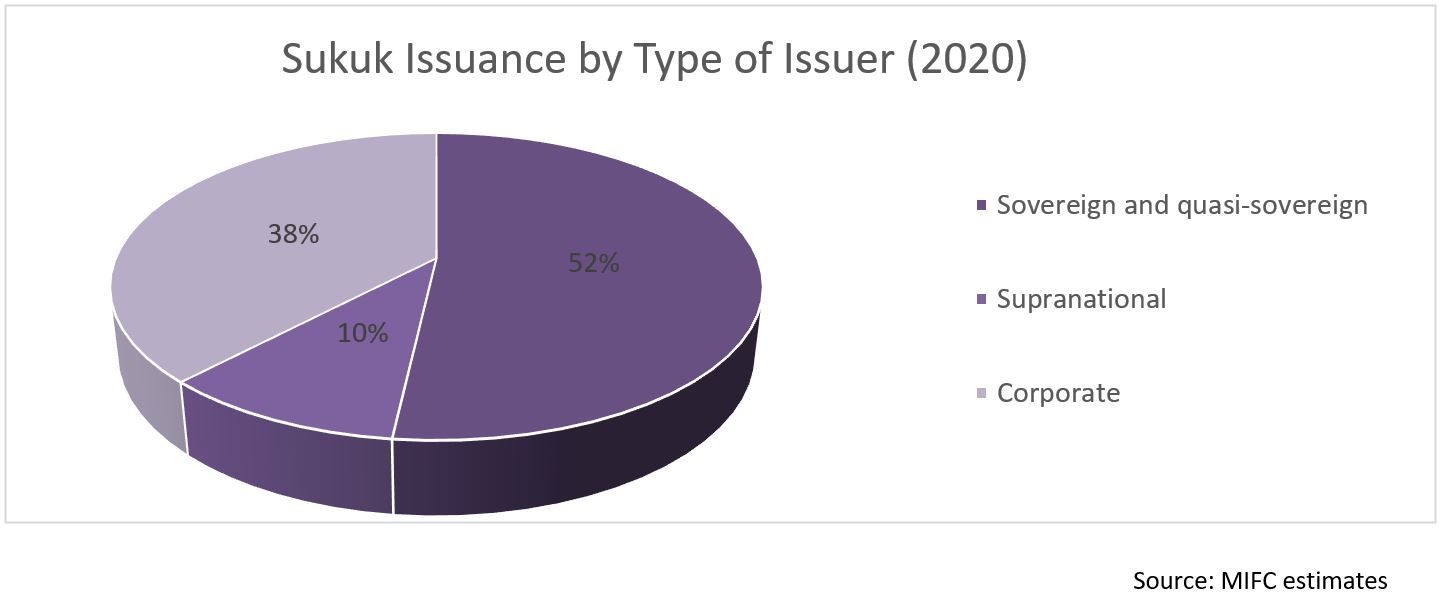

Value of corporate sukuk new issuances Malaysia 2016-2020 Average gross monthly yields on treasury bonds BTPs in Italy 2016-2021 US. Prime Minister Najib Razak announced in his 2016 budget speech. Global sukuk issuance posted a solid growth of 132 from previous year to reach USD748 billion.

This innovative Sukuk structure not only paves the way for other sovereigns to follow suit but also further affirms Malaysias position as the leader in international Islamic finance. These so called corporate sukuk new. Fitch Ratings has assigned Malaysias proposed US dollar-denominated sovereign global sukuk trust certificates to be issued by Malaysia Sukuk Global Berhad MSGB an expected A-EXP rating.

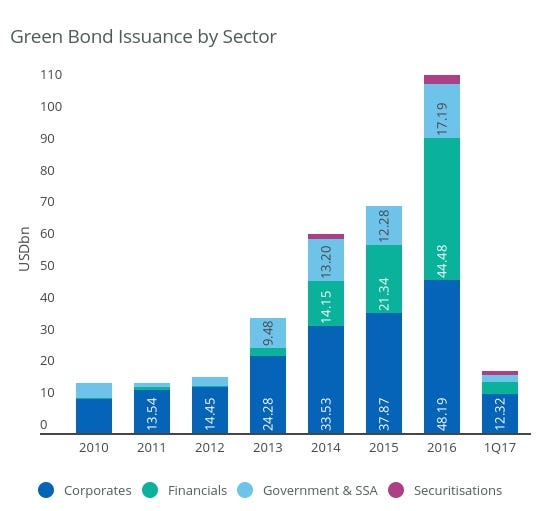

Developments in the SRI arena have catalysed the exponential growth of ASEAN sustainable bonds and sukuk. The sukuk value represented 452 of the total new corporate bonds and sukuk approved and lodged with the Securities Commission Malaysia SC of 56 amounting to RM14099 billion in 2016. AmInvestment Bank the third-biggest sukuk arranger in the Southeast Asian nation predicts as much as 70bn ringgit of issuance.

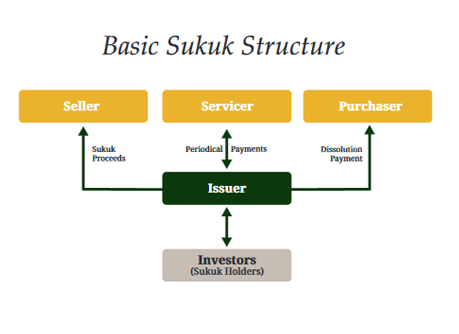

Between 2016 to 2020 the ASEAN6 markets saw significant increases at 198 CAGR in sustainable bonds and sukuk issuance for financing growth aligned with ESG principles with an issuance value estimated to have reached US298billion as. 102 Malaysia Bond Market Guide 2016 There are various types of sukuk given that a number of different Shariah principles are used for the creation of sukukThe more prominent types are the sale and purchase of an asset based on bai bithaman ajil deferred payment the leasing of specific ijarah assets and a musyarakah profit and loss-sharing scheme. 10 May 2010.

Overall sukuk issuer profile remained broadly similar to historical trends with Malaysia continued to be the main driver for sukuk issuance for the year. Mar 5 2021. In its Annual Report 2016 released yesterday the SC said the Islamic capital market ICM accounted for 5956 of Malaysias capital market.

Islamic banking in Malaysia was introduced via windows which allowed conventional financial institutions to offer Shariah-compliant banking products and. Fitch Ratings-Hong Kong-11 April 2016. The sukuk which will be scripless and based on Shariah principles is an additional investment instrument for Malaysian.

Pdf On The Potential Growth Of Sukuk Issues And Its Challenges Semantic Scholar

Why Green Sukuk Could Be A Growth Driver For Islamic Finance By Bashar Al Natoor Why Forum Medium

The Global Islamic Finance Market Part 1 Sukuk Bonds Tmf Group

Global Sukuk Issuance By Country 2020 Statista

Record Saudi Sukuk Broadens Market Global Finance Magazine

What S Fueling The Sukuk Issuance In 2016 The Asset

The Importance Of The Malaysian Sukuk Comparing With Other Countries Download Scientific Diagram

Gcc Sukuk A Primer Saturna Capital

Pdf On The Potential Growth Of Sukuk Issues And Its Challenges Semantic Scholar

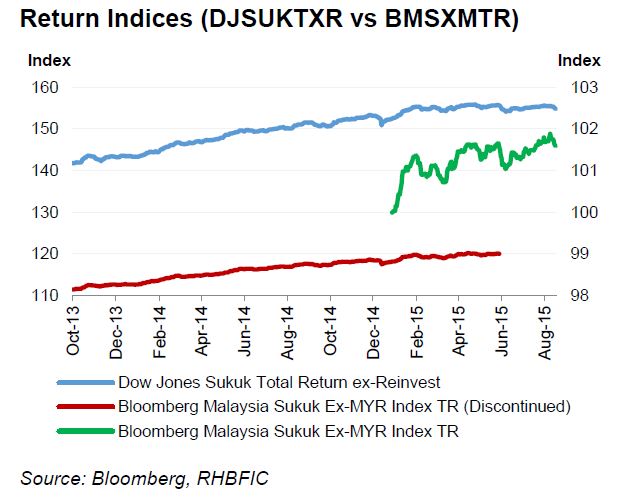

Rhb Weak Oil Price May Impact Sukuk Issuance

What Are Sukuk Azzad Asset Management Halal Investment

Four Ways To Invest In Sukuk As A Retail Investor Halal Investor

The Global Islamic Finance Market Part 1 Sukuk Bonds Islamic Finance Worldwide

Sukuk Growth And Distribution Download Scientific Diagram

Sukuk Market By Country Of Obligor Download Scientific Diagram

Sukuk Market Global Industry Trends Share Size Growth Opportunity And Forecast 2022 2027

Why Green Sukuk Could Be A Growth Driver For Islamic Finance By Bashar Al Natoor Why Forum Medium

Pdf On The Potential Growth Of Sukuk Issues And Its Challenges Semantic Scholar

Sukuk A Primer On All You Need To Know About Islamic Bonds